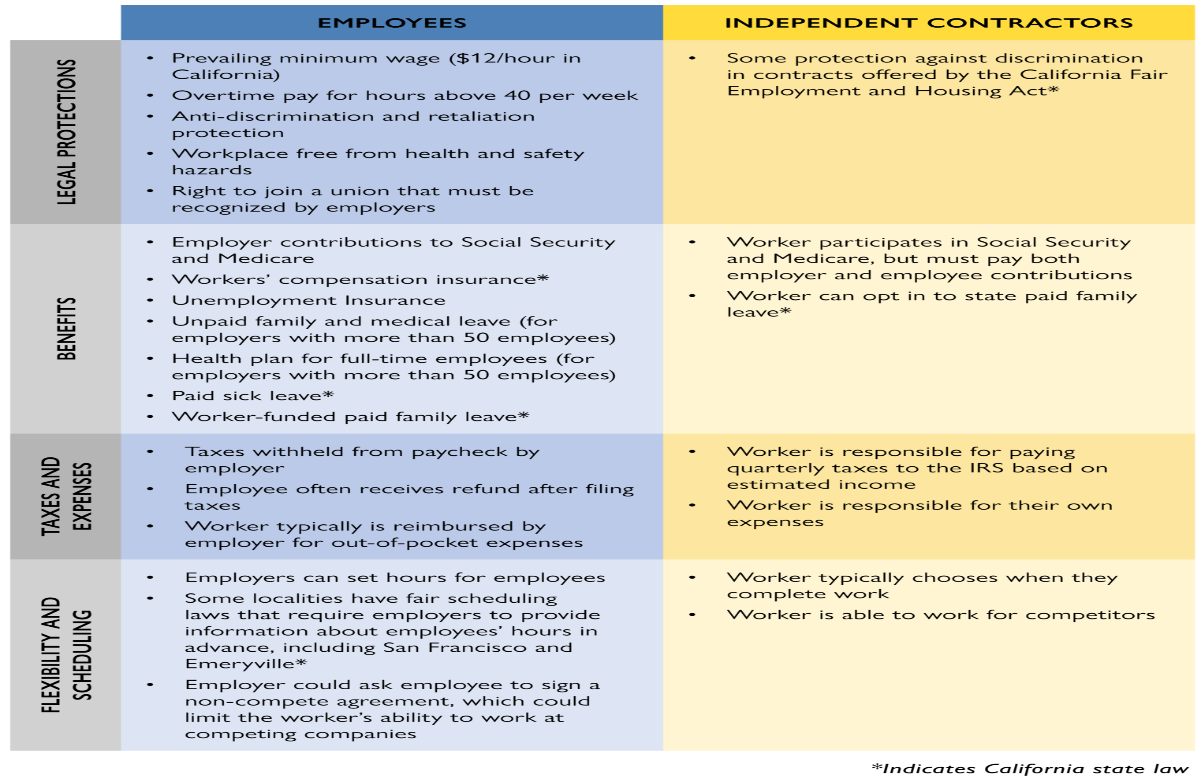

Independent Contractor Vs Employee Chart

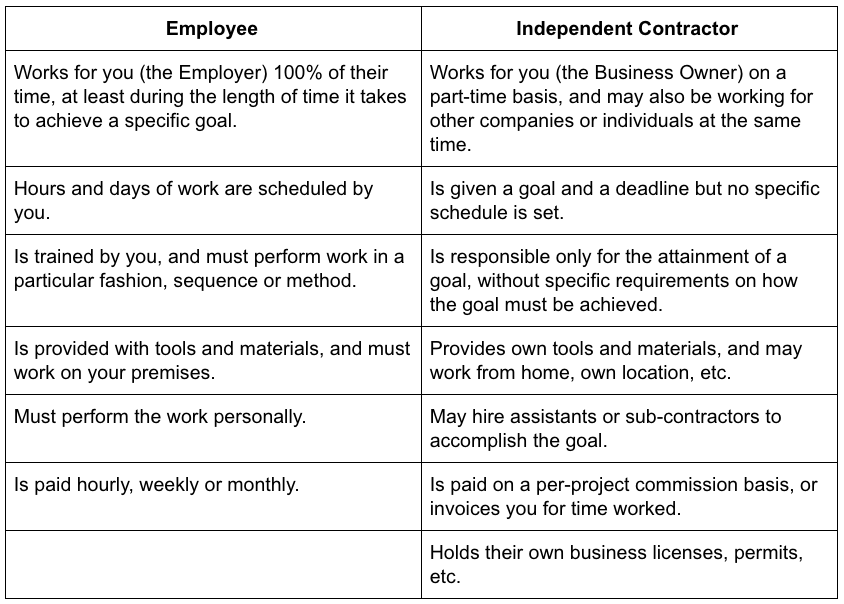

Independent Contractor Vs Employee Chart. Instead, there are a number of factors (set forth in the chart below) that courts and agencies use to decide if you are an independent contractor or employee. Independent contractors vs. employees: The differences.

An employee, on the other hand, relies on the business for steady income, gives up elements of control and independence, is eligible for certain benefits and works within constraint of.

The IRS, the Fair Labor Standards Act, and the common law have all helped define the differences between an employee and an independent contractor.

Once you've determined whether an independent contractor or employee is a better choice for your needs, you'll need to be certain you stay within the lines of the worker relationship. Am I an independent contractor or an employee? Independent contractor: In contrast, you won't receive any benefits as an independent contractor.

Rating: 100% based on 788 ratings. 5 user reviews.

Veronica Cain

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Independent Contractor Vs Employee Chart"

Post a Comment